Money worries can sometimes get big and gnarly. Growing up, I didn't get the best example when it came to money. As a kid I didn't really get a sense of how it should be managed, and by my early 20s I managed to rack up a nice pile of consumer debt.

I slowly clawed my way out from under that debt, but I didn't feel like I gained many budget-management skills along the way. In my 30s I was still constantly asking myself, "can I afford this?" — trying to navigate impulse buys with long-term planning, and not having a great sense of where my family and I stand when it came to money.

I wanted to do something about it. A friend had mentioned YNAB a few years back — we had a few conversations about it, but I didn't end up signing up. I remembered the name, though, and came back to it.

YNAB is a solid money-management app, purpose-built for a household budget. I didn't feel like that's what I needed: For me, this was starting from step 2. I felt like I needed some theory, a better understanding of household/family budgeting. I needed opinions.

That's when I found out the folks behind YNAB actually wrote a book. A real book, available for the Kindle. You'd think it would be a thinly-veiled ad — but no, it actually lays out their thinking around household budgeting and how it works in the real world.

That book was what I needed — that was the key. I read it from cover to cover, took notes, and then my wife and I started using YNAB.

Our budget is simple: It's a bunch of categories, divided into groups. The important ones come first. Each category can have a goal, and that goal can be monthly (groceries, for example) or it can add up over time (for some future "dream" expense, or something that happens once a year).

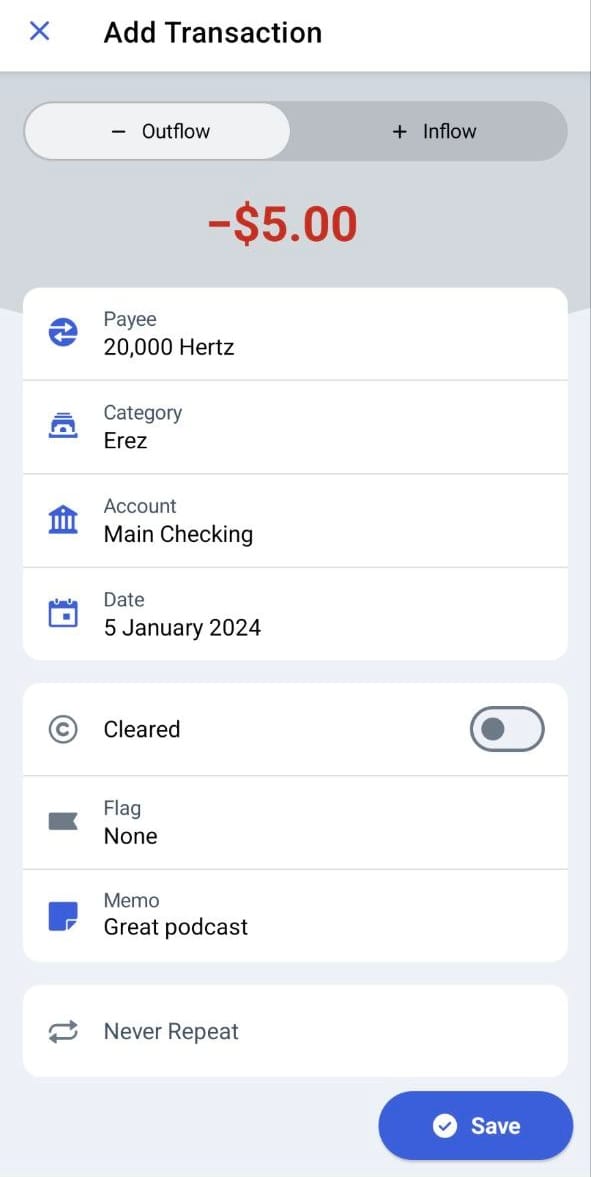

Then every month we allocate money to our different categories, and as we spend that money, we track it. Sounds dead simple — because it is. Every time we spend some money, we log it. There's a mobile app that works well, and the desktop version of the site is simple and fast (I'm not including a screenshot of the site below because it's meaningless without all of my personal info, but I'll show you what the mobile app looks like). It also makes it simple to shift money around between different categories throughout the month, in case there are surprise expenses (YNAB calls this "rolling with the punches").

So the experience is straightforward and flexible, just the right balance of power and simplicity. You can set up recurring expenses, and the mobile app can even use your location to try and guess where you just spent some money (to save on data entry). Not too automated, and not dumbed down. It gives us a clear sense of what's happening with our money. It feels like our data stays private and YNAB is on the same team as we are: The app costs money to use so it's in their best interest to simply serve their customers rather than try to mine their data.

We started using YNAB several years ago, and we haven't looked back since. Having a sane and clear household budget just adds so much peace of mind. We know where we stand, we know what our plans are — and most important, when there's a surprise, we can quickly adapt to it and understand how it changes our future plans.

YNAB isn't particularly complicated, so I don't have a ton of how-to tips to share. I do have one, though: Don't use automated sync. Don't connect it to your bank!

I know this sound counter-intuitive, and of course, the first thing I tried doing was doing just that, connecting it to our bank account. But the bank import sucked! It had all sorts of issues, and just ended up being confusing.

While I was thinking of ways to fix it, my wife made the surprising (to me) suggestion to simply turn it off and import transactions by hand. I don't mean exporting a CSV from the bank and importing it into YNAB — though that's possible, of course. I mean literally going line by line, entering data.

This one practice made such a difference for us. We have a weekly budget meeting, and we manually reconcile accounts. We try to enter expenses in the mobile app as they happen throughout the week, but if we miss something, we catch it in the weekly meeting. YNAB has a built-in "Reconcile" feature that helps with this process.

Even when using this Reconcile feature, it's still a manual process we go through every week, and that's the point. It keeps us in touch with our money, and in good communication with each other about our plans and our reality. The meeting is really an opportunity to communicate, not just do an admin task. It rarely takes more than half an hour, and it never fails to give me peace of mind.

The Surprise

Two surprises, really:

The first was that the book did not suck. It was clearly written, not overly verbose, and just plain useful. Even if you don't end up using YNAB, the book is worth reading, and their method works just as well with a spreadsheet too.

The second surprise was the realization that budgeting as a family isn't about numbers: It's about communication and building a future together. I didn't intuitively get that — budgeting just seemed like something that's equal parts stressful and boring. But a major realization for me was that really, having a weekly budget meeting unlocks so many conversations.

Why are we spending our money on X, rather than Y? Why are we spending so much here? Is it really worth it? Are there any goals we want to save for? There are many other such conversations, but you get the point: It was a surprise that budgeting can lead to deep and meaningful communication about the future.

So yes, I recommend budgeting in general — but that's often vague and hard to follow. For budgeting that's simple, concrete, and flexible, I recommend YNAB.